Bitcoin’s Onchain Slowdown: A Closer Look at the Current Trends in 2025

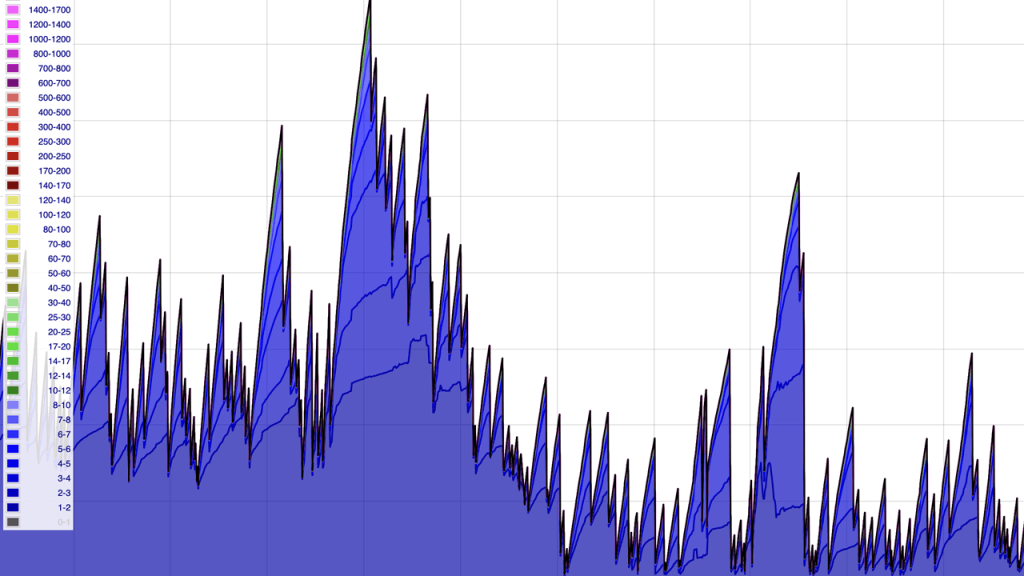

Bitcoin, the pioneering cryptocurrency, has witnessed a significant drop in its transactional activity in 2025, contrasting sharply with its peak levels from the previous year. Over the past eight months, daily transfer volumes have reached their lowest points, revealing a waning interest in Bitcoin transactions. This downturn has major implications for users, investors, and miners alike, leading to an environment marked by uncertainty and volatility.

The decline in Bitcoin’s daily transfer volumes can be attributed to several factors, including market sentiment, regulatory scrutiny, and changing investor behavior. As global economic conditions fluctuate, many investors are opting for a wait-and-see approach, hesitant to engage in frequent transactions. This cautious stance has resulted in sporadic activity on the Bitcoin blockchain, where blocks are being processed irregularly. Such inconsistencies can create unpredictable circumstances for miners who depend on a steady flow of transactions to sustain their operations.

Moreover, the current landscape of Bitcoin mining has become increasingly challenging. With reduced transaction fees stemming from lower daily volumes, miners are finding it more difficult to maintain profitability. Miners typically rely on transaction fees, in addition to block rewards, to fund their activities. As traffic on the network diminishes, the financial incentive for miners decreases, leading to potential network slowdowns. This creates a feedback loop, where fewer transactions lead to less incentive for miners, further exacerbating the decline in transactional activity.

Another contributing factor to Bitcoin’s sluggishness is the rise of alternative cryptocurrencies and decentralized finance (DeFi) projects. As other blockchain platforms emerge and offer competitive advantages, they have begun to attract users who may otherwise have engaged with Bitcoin. The proliferation of DeFi applications has diversified the cryptocurrency ecosystem, providing users with alternative means for generating yield and participating in financial systems that do not rely on Bitcoin’s traditional model.

Despite these challenges, experts argue that this phase of reduced activity may not be permanent. Bitcoin has a history of resilience and recovery, often rebounding from periods of low volume and price declines. Long-term investors continue to hold a substantial portion of their assets, suggesting confidence in Bitcoin’s potential to regain traction. Moreover, institutional interest remains, as entities recognize Bitcoin’s capacity to function as a hedge against inflation and economic instability.

In conclusion, Bitcoin’s current onchain slowdown in 2025 presents a complex scenario influenced by a variety of factors. While the decline in transactional activity can pose short-term challenges for miners and investors, the long-term outlook for Bitcoin remains cautiously optimistic. As the cryptocurrency landscape evolves, monitoring these trends will be essential for stakeholders in the Bitcoin ecosystem to navigate the shifting tides of blockchain technology and market dynamics effectively.