Title: Rising Odds of U.S. Recession in 2025: Analyzing Trade Policy Impacts and Economic Predictions

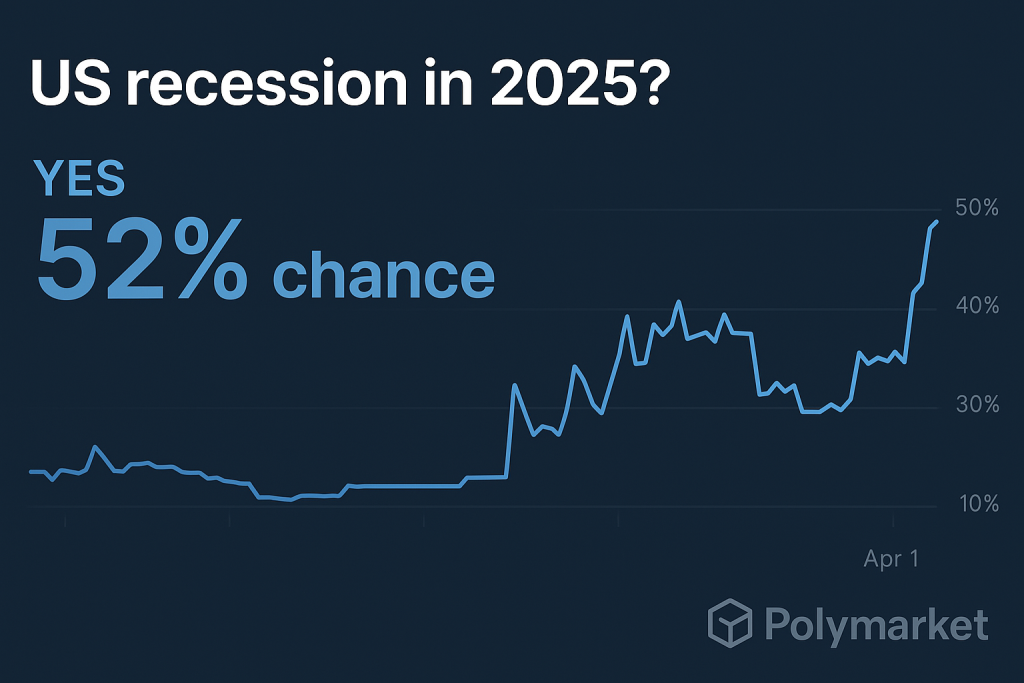

The Polymarket prediction platform recently showcased a notable shift in the odds of a U.S. recession in 2025, jumping from 22% to 52% in a single day—marking the steepest increase seen this year. This drastic revision in recession probabilities coincided with the U.S. administration’s announcement of a comprehensive new trade policy that implements a universal 10% tariff on all imports, alongside targeted “reciprocal” tariffs reaching up to 48% on goods from 60 countries. Understanding this sudden economic sentiment shift is crucial as it reflects broader anxieties regarding the potential repercussions of such drastic trade measures.

The newly introduced trade policy effectively removes long-standing exemptions that have traditionally shielded various categories from tariffs, including critical raw materials, medical supplies, and essential industrial inputs. Economists are increasingly concerned about the compounded economic impact this could create, with numerous interdependent factors at play. Rising input costs stemming from the tariffs, coupled with fragile supply chains and the specter of declining consumer demand, are significant points of concern. Analysts warn that these changes may lead to increasing inflation and an overall slowdown in economic activity, particularly as the effects ripple through different sectors.

In the short term, the imposition of tariffs is likely to contribute to inflationary pressures through cost pass-through effects on everyday goods—ranging from electronics to automotive parts and construction materials. With core inflation already at elevated levels and interest rates remaining high, the additional price shocks induced by tariffs are expected to suppress real disposable income. This shift will inevitably erode consumer demand, especially among lower-income households, raising concerns about the equity implications of such policy decisions.

Moreover, the vulnerabilities in U.S. supply chains become more pronounced as a result of the new trade regime. Many of the imported goods subject to tariffs lack domestic production alternatives, and the prospects for rapid onshoring or nearshoring by 2025 appear structurally unfeasible. This misalignment has intensified skepticism among investors concerning the policy’s practicality and its economic rationale. The growing apprehension is reflected in the volatility observed in prediction markets such as Polymarket, highlighting a broader uncertainty about the long-term impacts of these tariffs.

Despite the government’s efforts to frame this policy as a move toward reindustrialization and strategic leverage against other nations, analysts have noted discrepancies between the tariff figures justifying the new framework and data from recognized institutions like the World Trade Organization and the World Bank. Such inconsistencies have raised credibility issues around the assumptions supporting the trade strategy, undermining the original narrative. As a result, analysts argue for a more nuanced understanding of the potential consequences, rather than adhering to a simplistic interpretation of the tariff policy.

In conclusion, while the U.S. administration positions the new trade policy within a narrative of economic reformation and strategic positioning, the complexities and potential repercussions merit careful examination. The marked increase in recession odds on Polymarket signals an urgent need for scrutiny and discussion among economists and policymakers alike to ensure that proactive measures are taken to mitigate adverse effects and promote sustainable economic growth. As economic indicators evolve alongside these policy changes, public and private sectors must work collaboratively to navigate this challenging landscape effectively.