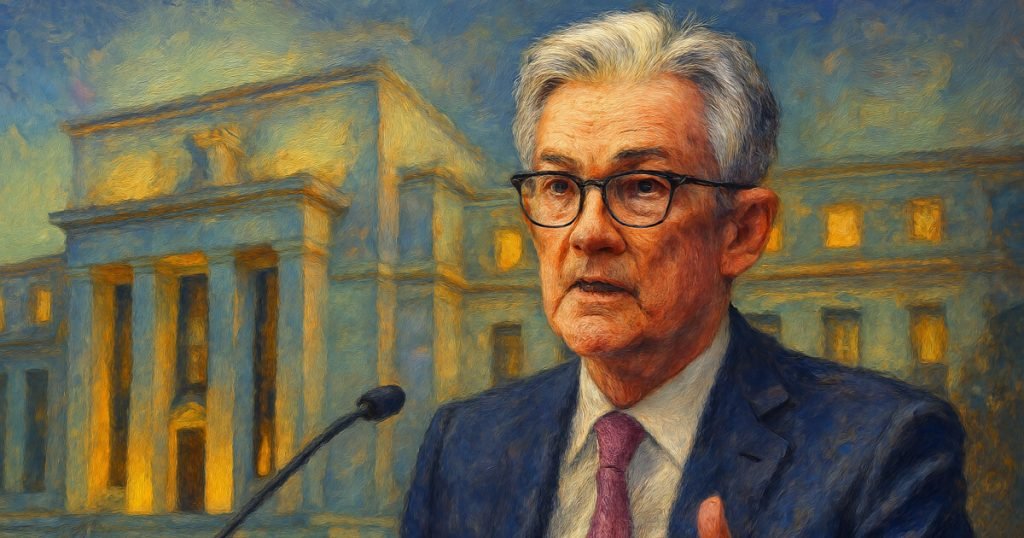

Economic Outlook Amid Tariffs and Inflation Concerns: Insights from Federal Reserve Chair Jerome Powell

On April 4, Federal Reserve Chair Jerome Powell delivered a concerning message regarding the economic implications of President Donald Trump’s newly announced tariffs. He warned that these tariffs, which are set at 10% and accompanied by retaliatory duties from several trading partners, could elevate inflation and slow down economic growth. During a business journalism event in Arlington, Powell remarked, “It is too soon to say what will be the appropriate path for monetary policy,” indicating the complexity of the current economic landscape.

The backdrop to Powell’s comments is the central bank’s extensive monitoring of economic developments. With the Fed recently deciding to maintain its benchmark interest rate between 4.25% and 4.50%, the outlook remains uncertain. Powell emphasized the Fed’s commitment to patience, stating, “Our obligation is to keep longer-term inflation expectations well anchored.” This highlights the Fed’s approach to navigating the potential turbulence introduced by tariffs while ensuring that a temporary spike in prices does not become a permanent issue.

While the U.S. economy is described by Powell as “in a good place,” with low unemployment and steady demand, he acknowledged growing consumer apprehensions about inflation, with core inflation remaining above the Fed’s target rate of 2%. As of February, core inflation stood at an annualized 2.8%. This context raises concerns about the potential repercussions of the tariffs on both consumer prices and overall economic performance. Market observers have noted rising expectations for interest rate cuts later in the year, but Powell’s remarks suggest the Fed is cautious about making any premature decisions.

Political pressures have also emerged, with President Trump urging the Fed to lower rates in response to inflationary concerns. However, Powell firmly rejected these influences, reaffirming the Fed’s independence and dual mandate of ensuring price stability and maximum employment. He underscored the relationship between tariffs and inflation, stating, “While tariffs are highly likely to generate at least a temporary rise in inflation, it is also possible that the effects could be more persistent.” This comment points to the potential for long-term economic adjustments that could follow the immediate impact of the tariffs.

Further complicating the situation are additional retaliatory tariffs from other countries, which may disrupt global trade dynamics and exacerbate inflation within the U.S. economy. Powell noted the uncertainty surrounding the duration of these new pricing pressures and how they might affect supply chains. The Fed’s careful watch on these developments underscores the importance of remaining responsive to external factors that can influence domestic economic stability.

In the world of cryptocurrency, Bitcoin (BTC) demonstrated resilience, trading above $83,000, which reflects its ongoing strength amid a backdrop of broader market volatility. At the time of the Fed’s statements, Bitcoin’s market cap was estimated at $1.65 trillion, with an impressive trading volume. As the Fed approaches its next policy review in early May, the market is keenly observing Powell’s insights and their implications for interest rates and economic strategies as the situation continues to evolve.

In summary, the intertwined concerns of inflation, tariffs, and economic growth prompt an intricate balancing act for the Federal Reserve. Chair Powell’s cautious stance signals the complexities at play, as both domestic policy and international trade considerations shift. The coming months will be critical in determining how these factors unfold and their eventual impact on the broader economy. Investors and consumers alike should remain vigilant as the Fed navigates through these uncertain waters.