Ethereum Price Analysis: Market Resilience Amid Stock Market Correction

In recent days, the US stock market has experienced a notable correction, yet Ethereum (ETH) has maintained its stability, holding firm at the critical support level of $1,800. Market analysts are beginning to express optimism, suggesting that Ethereum may have reached its bottom after experiencing a substantial 44% drop so far in 2025, indicating that ETH could be undervalued at this juncture. This duality of market movement highlights Ethereum’s resilience and raises questions about its potential future trajectory.

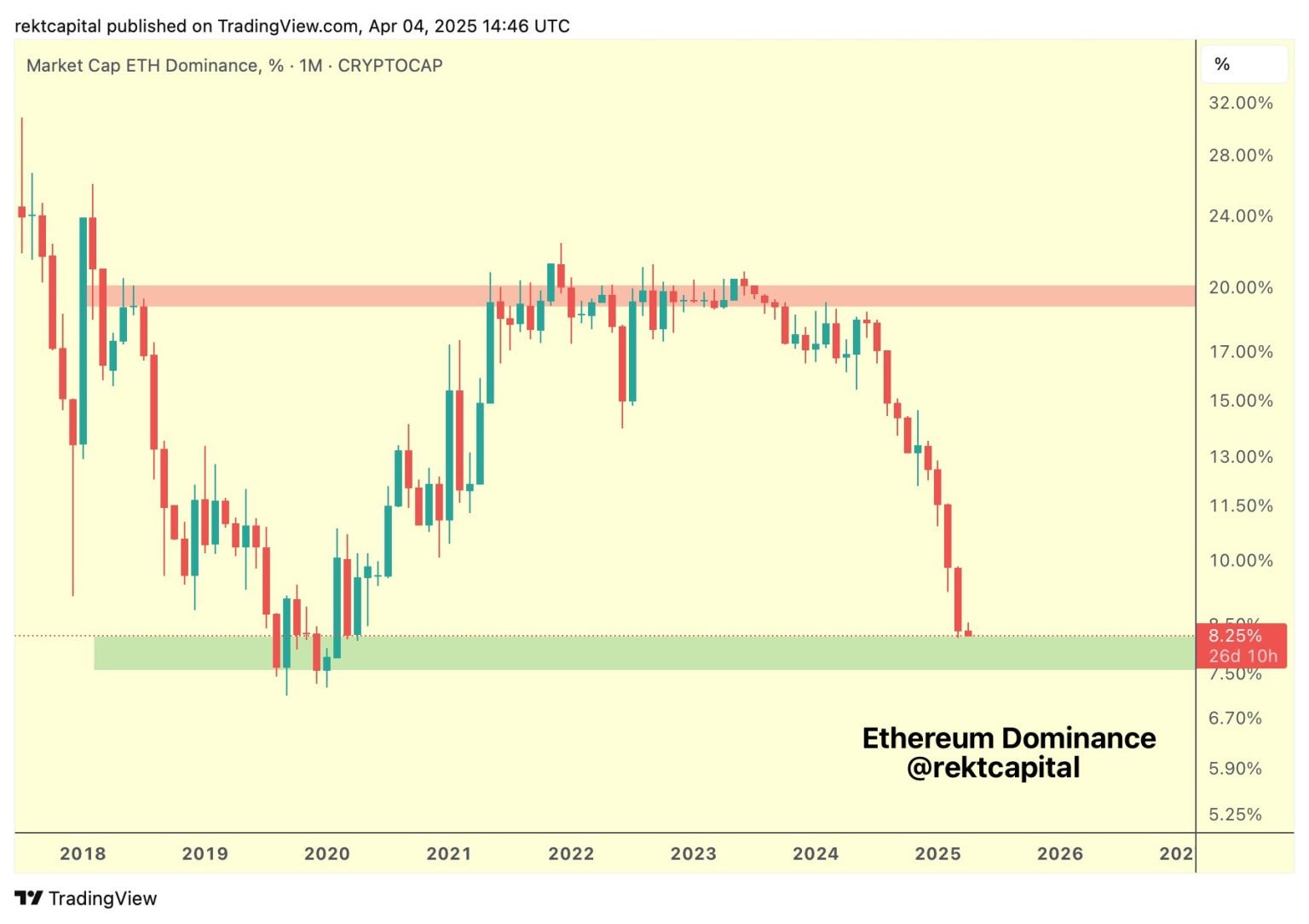

Ethereum’s Market Dominance at a Historic Low

Ethereum’s market dominance has significantly declined, dropping from 20% to just 8% since June 2023. This decline has raised flags among crypto analysts, including Rekt Capital, who pointed out that Ethereum is currently at a key historical reversal zone known as the "green area." This zone has historically marked strong rebounds for the cryptocurrency, suggesting that the conditions are ripe for a potential resurgence in Ethereum’s price. Investors may want to keep a close eye on this trend, as historical data indicates that such reversals can lead to dramatic price increases.

Bullish Divergence Signals Potential Reversal

Technical analysis reveals that Ethereum price charts exhibit signs of a regular bullish divergence, as identified by crypto analyst Javon Marks. Despite the recent price declines, this divergence indicates that bearish momentum might be losing strength, and bullish market forces could be poised to take over. Marks has set an ambitious price target of $4,000 for Ethereum, contingent on a sustained bullish reversal. If the market adheres to this positive trend, investors could witness substantial gains as Ethereum regains ground.

Favorable Risk-Reward Ratio for Investors

Currently, Ethereum presents a favorable risk-reward ratio for potential investors. With the downside perceived as limited to around $1,500, the upside potential appears promising, with projections of a potential price increase ranging from 100% to 250% from current levels. While ETH’s current support is at $1,650, a significant uptrend could materialize if the cryptocurrency rises past the pivotal $2,100 level with robust trading volumes. Although some indicators suggest a possible dip below $1,700 in the coming month, the overall sentiment remains cautiously optimistic, recommending a strategic approach to investment.

Whale Activity Adds Selling Pressure

While the outlook for Ethereum appears positive, the selling activity by large holders, often referred to as "whales," cannot be overlooked. Crypto analyst Ali Martinez recently reported a significant sell-off, with large holders offloading an impressive 500,000 ETH within just 48 hours. This movement could exert downward pressure on Ethereum’s price, countering the otherwise optimistic forecasts. As such, small and retail investors should consider this whale activity when assessing their investment strategies and risk tolerance in the Ethereum market.

Ethereum Struggles to Keep Pace with Bitcoin

Over the past year, Ethereum has struggled to maintain pace with Bitcoin, leading to a decline in the ETHBTC ratio to its lowest point in nearly five years. This trend raises concerns about the overall health of Ethereum in comparison to its more dominant counterpart. Nevertheless, as market conditions remain fluid, the cryptocurrency landscape is subject to rapid changes. Investors focusing on Ethereum should keep abreast of market trends, whale activity, and broader economic indicators, as these variables will influence the crypto platform’s performance moving forward.

In conclusion, Ethereum’s current performance amid stock market corrections showcases its resilience and potential for recovery. With market dominance at a historically low level, bullish divergences in technical analysis, and a favorable risk-reward ratio, investors may find it an opportune time to closely monitor ETH’s price movements. However, resistance from whale selling and relative weaknesses against Bitcoin remain key factors to consider. As always, investors should conduct thorough market research before making any cryptocurrency investments and stay informed about ongoing developments in the crypto space.