Title: First Digital Trust Denies Insolvency Amid TrueUSD Crisis: An In-Depth Analysis

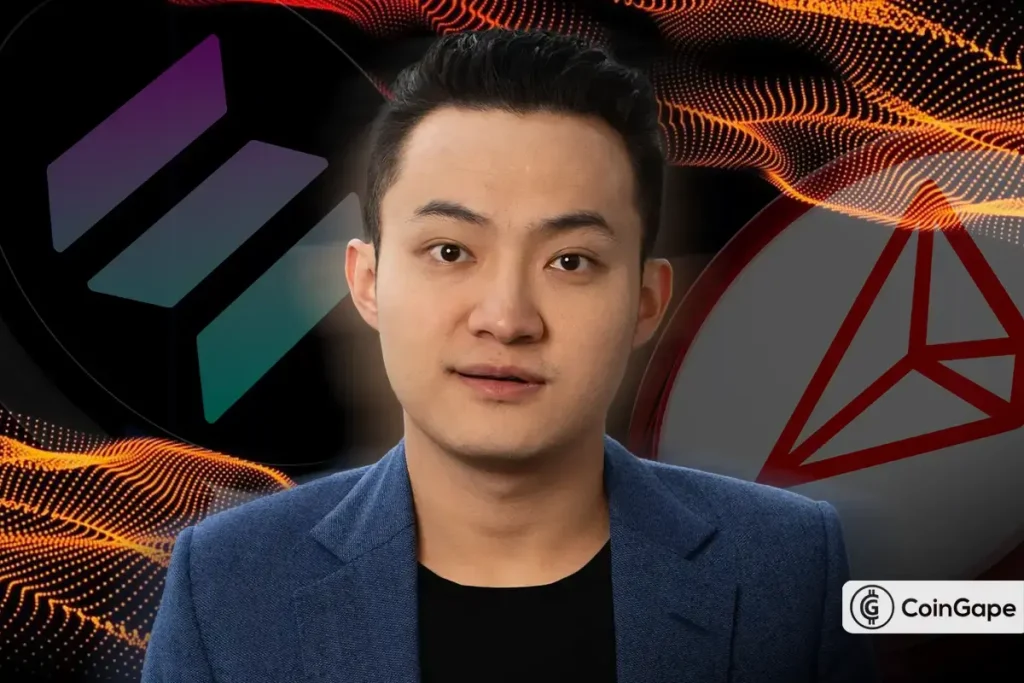

In the aftermath of a liquidity crisis involving TrueUSD (TUSD), First Digital Trust has made headlines with its strong denial of insolvency allegations. The Hong Kong-based Trust, entangled in the turbulence of TUSD, has publicly defended its financial health against accusations made by Tron founder Justin Sun. This article delves into the details of the crisis, the contrasting claims of First Digital Trust and Sun, and the broader implications for the stablecoin market.

First Digital Trust has issued a resolute statement declaring its full solvency and accusing Sun of spreading misinformation. The Trust claims its FDUSD stablecoin is adequately backed by US Treasury Bills, ensuring its financial reliability. They have characterized Sun’s remarks as a "smear campaign" designed to undermine a competitor. Such allegations arise from the current challenges faced by TrueUSD, which recently suffered a loss of its dollar peg, prompting Sun’s intervention aimed at stabilizing the asset with substantial capital support.

Sun, however, maintains his position that First Digital Trust is indeed insolvent. He has urged investors to dissociate from FDUSD, warning that the situation could escalate into legal consequences for Trust founder Vincent Chok. Following Sun’s accusations, FDUSD experienced a significant drop, falling to a low of $0.88, causing concern among investors as the asset lost approximately $130 million in market capitalization. Critics are now scrutinizing the trust’s liquidity and management amid these developments, heightening uncertainty in the market.

Within this backdrop, it’s important to note that the discord between First Digital Trust and Justin Sun reflects broader instability in the cryptocurrency ecosystem. The allegations come as U.S. regulators are moving towards implementing stricter rules for stablecoins, with initiatives like the GENIUS Act and the STABLE Act on the table. Such regulatory scrutiny could significantly affect operational practices in the industry, forcing companies to adapt quickly to maintain compliance and investor confidence.

Despite the ongoing tensions, First Digital Trust insists that the ongoing legal disputes concerning TUSD do not implicate FDUSD, highlighting that their stablecoin operates independently. This assertion aims to ease concerns surrounding its solvency and protect its reputation in a climate punctuated by fear and speculation. The Trust’s management has expressed frustration over being unable to present its case directly in legal settings, attributing the turbulence to public and social media battles rather than factual insolvency.

As the drama unfolds, the market remains on edge with the volatility of FDUSD and the impact of Sun’s actions reverberating through the investor community. The situation signals the importance of due diligence among investors, particularly in assessing the solvency and operational integrity of stablecoin issuers. The larger implications extend beyond immediate financial health, indicating a shifting landscape in the cryptocurrency arena that may influence the very future of stablecoins and regulatory oversight.

In conclusion, the ongoing dispute between First Digital Trust and Justin Sun encapsulates the complexities of the cryptocurrency sector, particularly surrounding stablecoins. As First Digital Trust stands firm in its claims of solvency against sensationalistic accusations, the scenario serves as a critical reminder of the volatile nature of the market. Investors are compelled to navigate these turbulent waters cautiously, armed with knowledge and a keen awareness of regulatory developments and the implications for stablecoin operations. As this story continues to evolve, it highlights the fragile balance of trust and transparency in the rapidly developing world of digital currencies.