Bitcoin’s Volatile Rollercoaster Amid Global Tariff Wars: What Investors Need to Know

Bitcoin, the leading cryptocurrency, has recently faced significant turbulence, crashing below the $75,000 mark for the second time in just one week. This downturn coincides with the implementation of Donald Trump’s sweeping 104% tariff on China, which has stirred uncertainty across global markets. As a result, cryptocurrencies and equities are experiencing extreme volatility, with Bitcoin extending its losses to 11% in just one week. Other altcoins, particularly Ethereum (ETH), are taking an even harder hit, with weekly declines exceeding 25%. Investors are finding themselves caught in a storm of market fluctuations, prompting critical reassessment of their holdings in an increasingly risky environment.

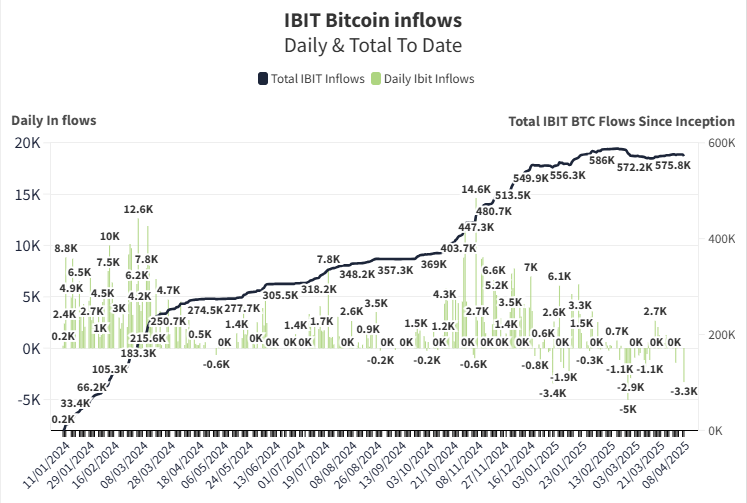

The ongoing tariff tensions between the United States and China have led to heightened anxiety among institutional investors. Recent data show that institutional selling of Bitcoin has ramped up, with the BlackRock iShares Bitcoin Trust (IBIT) shedding an astounding 3,296 Bitcoin in a single day, marking one of the largest outflows since its inception. Following this trend, the total net outflows from all U.S. Bitcoin ETFs reached $326 million yesterday. The market has also seen a stark bull trap where Bitcoin momentarily spiked to $80,400 during a relief rally, only to relinquish all gains as Trump’s tariff strategy continues to exert pressure on price stability.

As Bitcoin and other cryptocurrencies plunge, many analysts are bracing for potentially more drastic declines. In the wake of recent economic developments, BTC is currently down over 18% year-to-date, with some analysts predicting a further correction down to $70,000. The fallout is not limited to cryptocurrencies; stock and gold markets are responding negatively as fears abound regarding the likelihood of a full-blown recession. Renowned economist Peter Schiff has identified a concerning trend, stating that Trump’s efforts to destabilize the stock market in hopes of lowering long-term interest rates have instead led to rising yields on U.S. Treasury bonds.

Amid this precarious landscape, attention is shifting toward potential policy responses from the Federal Reserve, particularly regarding interest rate cuts expected around May. As financial experts draw parallels to December 2018 market conditions, there is growing speculation that the Fed may signal a pivot to prevent further market deterioration. Global Macro Investor and Real Vision founder highlighted this sentiment, suggesting that the perceived risk in stocks offers a 10% downside but a far more promising 25% upside in the coming months. This encouraging forecast hinges on the resolution of trade tensions between the U.S. and China, emphasizing the interconnectedness of geopolitical stability and market performance.

Arthur Hayes, CEO of BitMEX, has echoed sentiments that now is a critical juncture for Federal Reserve intervention. He raises concerns about the flow of capital amid growing global uncertainty and anticipates an influx of Chinese money into Bitcoin should these conditions continue to worsen. In his recent commentary, Hayes underscored the Fed’s precarious position by contrasting current market dynamics, noting how a combination of falling stocks and rising yields creates an alarming scenario, diverging from historical trends where lower stock prices typically align with decreasing bond yields.

In conclusion, Bitcoin’s recent price movements reflect deeper issues stemming from global economic pressures and policy decisions. Investors are closely monitoring these developments, particularly the ongoing U.S.-China tariff war, which is expected to have lasting impacts on the cryptocurrency market and beyond. With the potential for rate cuts and intervention from the Federal Reserve on the horizon, market participants may find renewed optimism, but caution remains paramount as uncertainty persists. As cryptocurrencies continue to navigate these choppy waters, investors must stay informed and agile, ready to adapt to a rapidly evolving financial landscape.