Bitcoin Price Decline: What You Need to Know

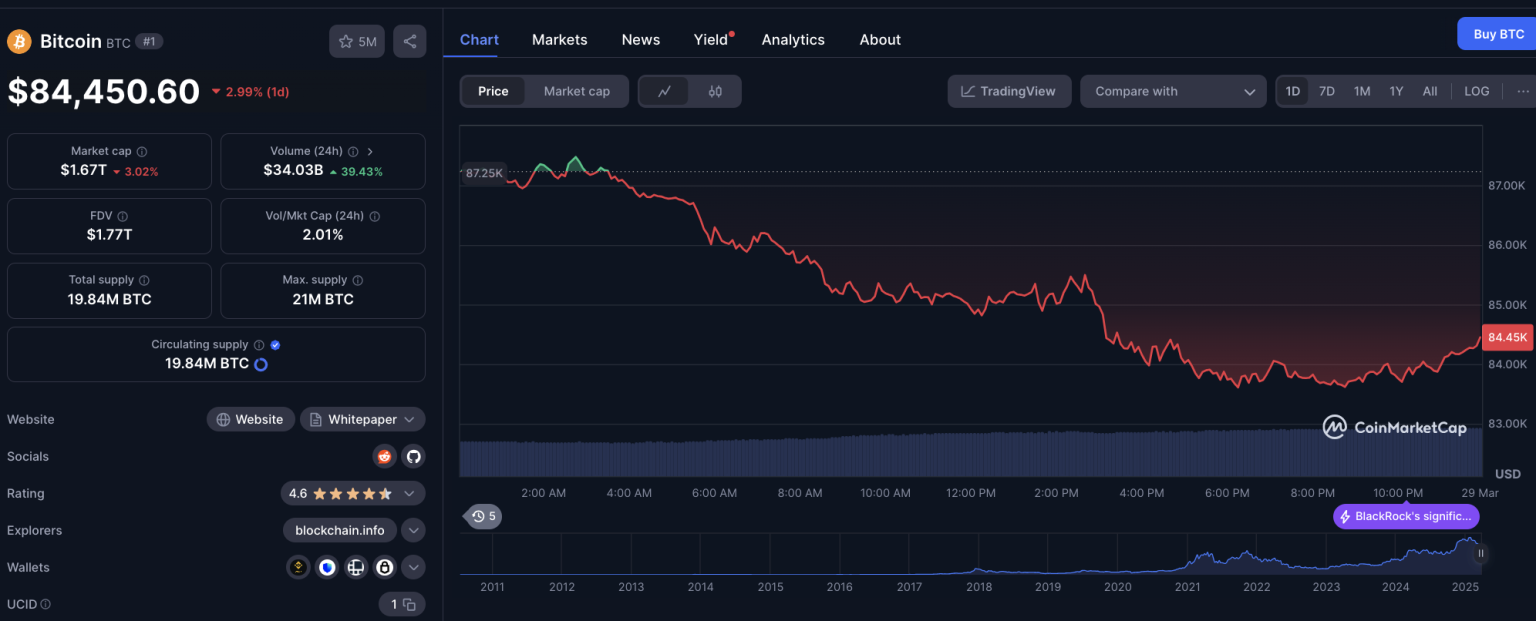

Bitcoin (BTC) has recently experienced a significant price plunge, tumbling below the crucial support level of $85,000 for the first time in a while. On Friday, the cryptocurrency hit a low of $84,200, driven by intense market-wide selling pressure. This widespread liquidation across the cryptocurrency space has seen about $400 million in crypto positions liquidated, with a staggering $116 million attributed solely to Bitcoin long positions. As BTC continues to struggle with market weakness, many investors are left questioning the future trajectory of the leading digital asset.

One contributing factor to Bitcoin’s recent decline was a series of wallet transactions linked to the U.S. government, where 97 BTC and 884 ETH were transferred. This event sparked rumors of a potential sell-off, causing further panic in the market. However, analysts believe that these transactions might be part of a broader initiative by the federal government to consolidate its cryptocurrency holdings, particularly in light of the executive order issued by former President Trump on March 6. This order requires federal agencies to report their cryptocurrency assets, and it is possible that the transfers were executed more as an administrative requirement than signs of an impending liquidation.

The bearish sentiment has also been reinforced by veteran trader Peter Brandt’s recent analysis. Brandt has predicted a downside target of $65,635 for Bitcoin, citing technical patterns that suggest a breakdown is imminent. According to his assessment, Bitcoin has completed a bear wedge pattern following a double top formation, which he believes sets the stage for further downward movement. Brandt emphasizes that his predictions are based solely on chart evaluations and that the technical indicators point to bearish momentum until proven otherwise.

The implications of such technical analysis are concerning for traders actively monitoring Bitcoin’s performance. Brandt’s chart highlights how Bitcoin faced resistance at $92,070 and subsequently formed lower highs, leading to a potentially significant correction. If the price continues to decline below the $85,285 threshold, it could pave the way for more severe setbacks that may see Bitcoin retesting the $75,000 level before approaching the projected $65,635 downside.

With market sentiment skewed towards pessimism, traders remain vigilant and cautious. The next few days will be pivotal in determining whether Bitcoin can stabilize and reclaim its previous key levels or whether it will continue to plunge into deeper correction territory. External market influences, macroeconomic indicators, and investor sentiment will largely determine the short-term future for BTC.

In conclusion, the recent decline in Bitcoin’s price serves as a stark reminder of the inherent volatility in cryptocurrency markets. With significant liquidations occurring and bearish forecasts from esteemed analysts like Peter Brandt, investors should approach the cryptocurrency landscape with heightened caution. It is essential for anyone involved in crypto trading or investment to remain informed about developing trends and macroeconomic conditions that could affect their positions and overall market dynamics.

FAQs

1. Why did Bitcoin fall below $85,000?

Bitcoin’s price drop below $85,000 was triggered by increased selling pressure, significant market liquidations, and concerns related to U.S. government-associated crypto transactions.

2. What is Peter Brandt’s prediction for Bitcoin?

Veteran trader Peter Brandt has forecasted a bearish target of $65,635 for Bitcoin, citing a completed bear wedge pattern and continuous downside risks.

3. How much was liquidated in Bitcoin long positions?

In the past 24 hours, there were $116 million in Bitcoin long positions wiped out, contributing to a total of $400 million in liquidations across the crypto market.

In conclusion, as Bitcoin continues to struggle with its price stability, market participants must stay informed and be prepared for the potential for further volatility.