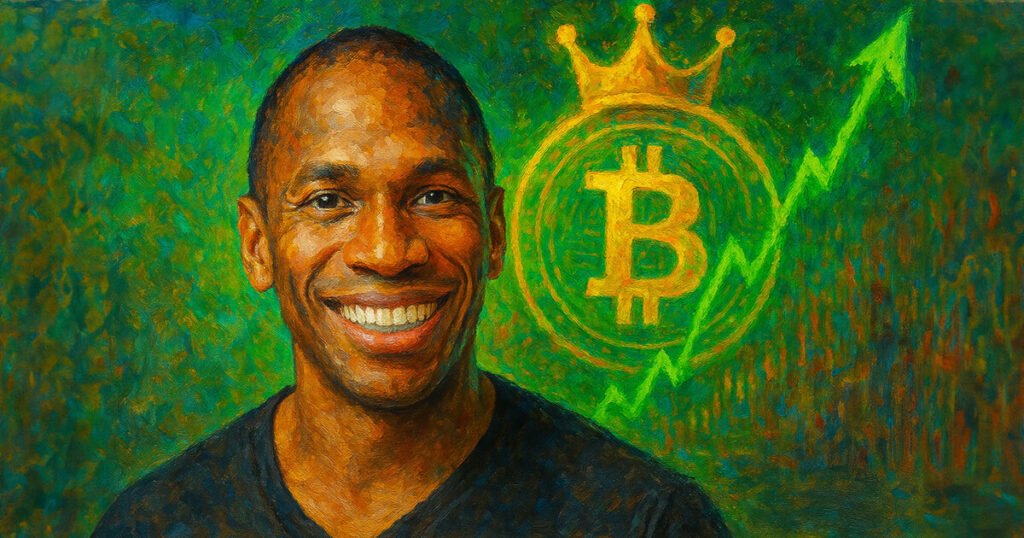

Title: Bitcoin’s Dominance Set to Rise Amid Global Financial Turbulence: Insights from Arthur Hayes

Paragraph 1: The Impact of Global Financial Uncertainty on Bitcoin’s Market Share

Arthur Hayes, co-founder of BitMEX, has posited that Bitcoin’s market dominance is on a trajectory towards 70% as global financial uncertainty escalates. In his April 7 post on social media platform X, Hayes stated that amidst the current economic tension, risk appetite for altcoins has significantly waned. Interventions by the Federal Reserve, which he considers unavoidable given the intensifying economic pressures, could catalyze another wave of money printing. He argues that this situation positions Bitcoin as the safer investment, attracting individuals and institutions alike seeking stability amid volatility. As of now, Bitcoin constitutes approximately 63% of the overall cryptocurrency market capitalization, a notable resurgence and the highest level it has reached in over four years.

Paragraph 2: The ‘Black Monday’ Stock Market Drop

The past few days have witnessed tumultuous shifts in global stock markets, largely attributed to the sweeping 10% tariff imposed by the Donald Trump administration on imports, hitting key trade partners including China and the European Union. This trade announcement resulted in a sudden market panic, with significant declines fielded across global exchanges. For instance, the Hong Kong market encountered a staggering 13% drop, marking its worst performance since 1997, while mainland China observed its most considerable single-day loss since the 2008 financial crisis. Additionally, the US stock market has been facing similar adversities, with the S&P 500 futures plummeting by 22% and shedding an average of $400 billion per trading day for more than a month. In the crypto realm, fellow traders weren’t spared either, as liquidations exceeded $1.3 billion in the last 24 hours alone.

Paragraph 3: The Shift to Neutral Assets and the Role of Bitcoin

Hayes has long argued that the traditional financial landscape, heavily influenced by the US dollar, is exhibiting cracks amidst the current economic strain. He elucidates a dire scenario: if the US current account deficit is eradicated, foreign entities may lack the dollars to invest in US bonds and stocks. This scenario unfolds as countries reorient their economic strategies toward national interests, potentially leading to a sell-off of US assets. In this uncertain financial climate, Hayes foresees a burgeoning demand for assets insulated from governmental control, identifying Bitcoin as an increasingly favorable option. Unlike traditional assets like gold, which serve as a historical hedge against instability, Bitcoin offers unique advantages due to its decentralized nature and growing acceptance.

Paragraph 4: The Rationale for Bitcoin’s Rising Appeal

The appeal of Bitcoin intensifies in a world marked by distrust of government-provided financial systems. To an increasing number of investors, Bitcoin represents a novel form of wealth detached from traditional financial infrastructure. In Hayes’ view, as confidence in conventional financial systems wanes, Bitcoin’s prominence is set to rise significantly. The decentralized and borderless nature of Bitcoin allows it to operate beyond the reach of any single nation’s monetary policy, making it an attractive alternative during periods of economic distress. This potential for independence and its supply-demand dynamics position Bitcoin not just as a digital currency, but as a pivotal asset class in the evolving financial paradigm.

Paragraph 5: Future Price Projections for Bitcoin

As the demand for decentralized assets accelerates, Hayes anticipates Bitcoin could potentially reach a valuation of $1 million. This projection stems from two converging trends: the escalating lack of confidence in traditional financial structures and the increasing adoption of crypto assets by individuals and institutions as part of their diversification strategies. The current financial landscape, where monetary policies seem increasingly ineffective, may drive more investors towards Bitcoin, primarily due to its limited supply and deflationary characteristics. As market dynamics shift, Hayes believes Bitcoin will solidify its role at the forefront of the evolving global financial system.

Paragraph 6: Conclusion and the Future of Cryptocurrency

In conclusion, the insights from Arthur Hayes reflect the broader sentiment engulfing the cryptocurrency landscape amid global financial turbulence. With Bitcoin’s market dominance likely pushing toward 70%, investors are granted a glimpse into a future where digital assets assume increased significance as safeguards against economic uncertainty. As traditional markets experience unprecedented volatility, Bitcoin presents a resilient alternative that addresses the needs of a shifting investor base. As central banks tinker with monetary policy, the call for neutral assets such as Bitcoin is likely to grow louder, paving the way for a transformative phase in the history of finance that cannot be ignored. As we look ahead, the interplay between traditional markets and cryptocurrency will be intriguing to watch, particularly in how it shapes investor behavior and market dynamics.