Bitcoin and Altcoins Resilience Amid Market Tumult: What Lies Ahead?

Despite a significant 1000-point crash on the Nasdaq index recently, Bitcoin (BTC) and various altcoins have shown remarkable resilience. This persistence comes as crypto market investors appear undeterred by the latest developments regarding Trump-led tariffs, indicating a distinct psychological shift toward the potential of digital assets. As of today, Bitcoin’s price has seen a slight dip of just 1%, resting at approximately $82,698. This is noteworthy considering the intense volatility it experienced earlier in the week. All eyes are now on next month’s Federal Open Market Committee (FOMC) meeting, where investors will be keenly observing whether Fed Chair Jerome Powell signals any potential rate cuts in light of the ongoing market turbulence.

Where Is Bitcoin Price Headed? A Volatile Week Unfolds

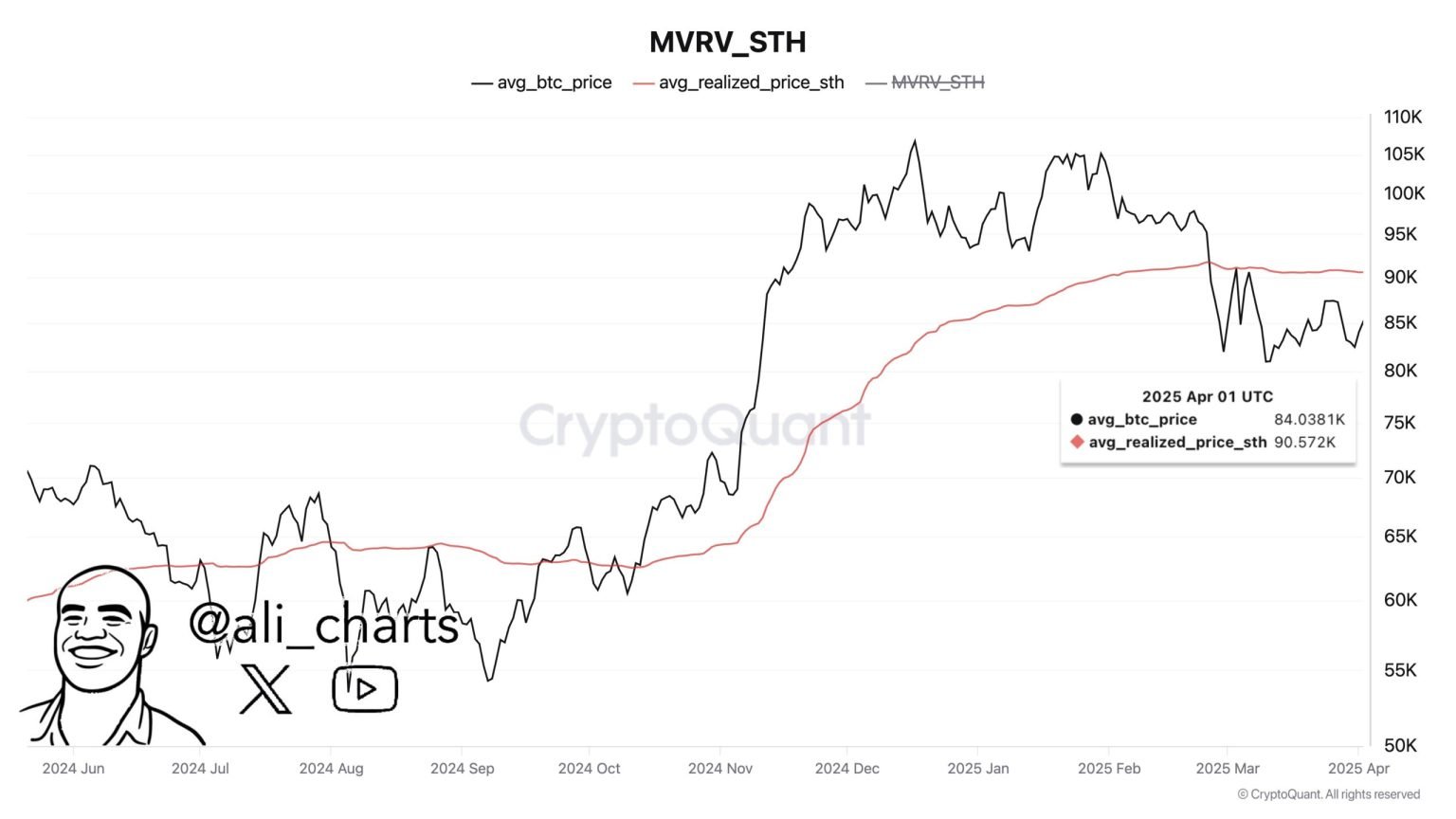

In the past week, Bitcoin’s price witnessed significant fluctuations, oscillating between $82,000 and $89,000. The onset of Trump’s reciprocal tariffs on April 2 led to a sharp decline, where BTC plummeted from $88,000 to lows of $82,000. Yet, despite the Nasdaq encountering a 6% drop and the S&P 500 falling by 5% on Thursday, Bitcoin and the broader cryptocurrency market exhibited a level of resilience not visible in traditional markets. Crypto analyst Ali Martinez has pointed out an important technical indicator that could signal a potential rebound for BTC. He argues that the first clear signpost of a new bull run would be reclaiming the short-term holder realized price level, which currently stands at $90,570.

Outlook on Federal Reserve Rate Cuts in May

As cryptocurrency investors navigate these turbulent waters, traders are estimating only a 27.1% probability of a 25-basis point rate cut during the upcoming FOMC meeting on May 7. This low probability reflects a general consensus that the U.S. Federal Reserve is unlikely to veer from its current monetary policy trajectory. Fed Chair Powell has maintained a cautious approach, indicating that more evidence of diminishing inflation may be necessary before any interest rate adjustments are considered. Notably, popular crypto analyst Titan of Crypto emphasizes that Bitcoin must break out from a prevailing falling wedge pattern for sentiment to shift positively. He remains hopeful that inflation metrics such as CPI and Core PCE will improve in the coming months, as data from Trueflation suggests a significant cooling in inflation pressure.

Will Altcoins Recover Soon? A Bullish Signal Emerges

The altcoin market has encountered a stark downturn since the beginning of 2025, with major cryptocurrencies like Ethereum (ETH) and Solana (SOL) experiencing corrections of up to 30-40%. However, many analysts are optimistic that this moment might mark the end of the bear market phase for altcoins. There is growing sentiment among market participants that the bottom may have been reached and that altcoins are poised for a rally in the near future. Crypto analyst Wimar.X has issued a bullish signal regarding the altcoin market, noting a key technical crossover that historically precedes significant rallies. In past cycles, similar indicators have resulted in astounding altcoin surges ranging from 1,000% to 2,000%, reigniting hopes for potential gains in the near future.

Implications for Cryptocurrency Investors and Traders

As the cryptocurrency market navigates the dual pressures of external factors such as the Trump tariffs and internal dynamics like Fed policy decisions, investors must remain vigilant. Despite the recent volatility, established cryptocurrencies like Bitcoin and emerging altcoins show potential signs of recovery, largely spurred by technical indicators and market sentiment. If Bitcoin successfully breaks the critical resistance level articulated by analysts, it could ignite a rush of investment activity, paving the way for a bullish trajectory throughout the remainder of the year. For altcoins, the emergence of bullish patterns hints at a possibility for recovery, fostering optimism amid the broader struggle against market forces.

Conclusion: Navigating the Crypto Landscape with Caution

In summary, while recent market events have caused significant fluctuation in cryptocurrency prices, the current resilience exhibited by Bitcoin and altcoins presents a narrative of potential recovery. As traders and investors inch closer to key moments such as the Federal Open Market Committee meeting and continued fluctuations in traditional markets, attention to technical indicators and economic signals will be crucial. Those willing to navigate this complex landscape should conduct thorough research and remain adaptable to the evolving dynamics that shape the cryptocurrency market. The current phase may just mark the beginning of a significant upward trend, contingent on favorable conditions and market reactions to forthcoming developments.

As always, cautious investment practices and informed decision-making should guide participation in this increasingly dynamic space.